Articles

How to Learn to Use Convex for Database Applications

In the ever-evolving world of database technologies, managing and storing data efficiently is crucial for developers and businesses alike. Convex is an innovative database and application platform designed to simplify data management, app development, and scaling. Whether you’re a beginner or an experienced developer, this guide will help you learn Convex for database applications step by step.

1. Understand the Basics of Database Technologies

Before diving into Convex, it’s important to have a solid understanding of basic database concepts. This includes knowledge of both relational databases (like SQL) and non-relational databases (like NoSQL), data modeling, and querying. Familiarizing yourself with these foundational concepts will set you up for success when learning Convex. If you’re new to databases, consider exploring these topics to ensure you’re ready for the next steps.

2. Explore the Convex Platform Overview

Convex is designed to offer a streamlined experience for managing and querying databases within applications. To get started, take some time to explore the Convex platform and its features. Visit the official Convex website to read introductory materials, check out user case studies, and understand its architecture. Familiarizing yourself with how Convex integrates data storage, querying, and app logic will help you better utilize its full potential.

3. Dive into Official Convex Documentation

One of the best resources for learning Convex is its official documentation. The comprehensive guides cover topics from setting up your environment to building complex applications. Key areas to focus on include:

- Setting Up Convex: Learn how to get started with Convex, including account setup, platform installation, and basic configuration.

- API Reference: The Convex API documentation is a critical resource that provides detailed descriptions of available functions, methods, and services you can use to interact with your database.

The documentation also includes practical code examples and use cases that will speed up your learning process.

4. Follow Step-by-Step Tutorials and Guides

To gain hands-on experience, follow the tutorials and getting started guides on the Convex website. These resources offer step-by-step instructions that walk you through creating your first database-backed application. Following along with these guides will give you a clear sense of how Convex works and how to integrate it into your projects. You may also want to explore sample projects available within the community to see how others are using Convex in real-world applications.

5. Hands-On Practice: Build Your First Convex Project

The most effective way to learn any new tool is through hands-on practice. Start with a simple project, such as a to-do app or a basic blog, and build it using Convex. Focus on:

- Data Modeling: Learn how to define and structure your data efficiently.

- Querying Data: Explore how to interact with your data using Convex’s query language.

- Deploying Your Application: Experiment with deploying your Convex-powered app to see how it scales.

By building small applications, you’ll gain practical insights into how Convex handles database operations, authentication, and serverless functions.

6. Engage with the Convex Community

Convex has a thriving developer community that can provide support, advice, and best practices as you learn. Join the Convex community forum or engage on platforms like Slack, Discord, and GitHub. Asking questions, sharing experiences, and collaborating with other developers will help you overcome challenges and accelerate your learning process.

7. Leverage Educational Resources for Learning Convex

If you’re looking for more structured learning, consider enrolling in online courses or watching tutorials on platforms like Udemy, Coursera, or YouTube. Some of these platforms offer in-depth courses on Convex and database management, with step-by-step instructions and hands-on projects. Additionally, attending Convex webinars and workshops can give you deeper insights from experts and the community.

8. Stay Updated with Convex’s Latest Features

The world of database technologies and application platforms is constantly evolving. Stay informed about the latest updates and new features in Convex by subscribing to the Convex newsletter or following the official Convex blog. Regularly check for updates and best practices, as this will help you stay competitive in a fast-moving industry.

9. Build Real-World Applications with Convex

Once you’ve gained a solid understanding of Convex, apply your knowledge by building real-world applications. Start with smaller projects and gradually scale up to more complex systems, such as e-commerce platforms, content management systems, or social networks. Real-world experience will allow you to refine your skills and deepen your understanding of database scalability, security, and performance optimization.

10. Collaborate and Network with Other Developers

Collaboration can help accelerate your learning and open up new opportunities. Join developer meetups, hackathons, and industry events to connect with other Convex users and industry professionals. Networking and working on collaborative projects can expose you to different ways of thinking and problem-solving.

11. Learn Security Best Practices for Convex

When using Convex (or any database platform), security should always be a top priority. Learn how to:

- Secure your data with encryption and authentication mechanisms.

- Implement best practices for API security, such as OAuth and JWT.

- Monitor and optimize the performance of your applications to ensure scalability.

By understanding and applying these best practices, you’ll ensure that your Convex-powered applications are both secure and high-performing.

Master Convex for Effective Database Management

Learning to use Convex for database applications is a rewarding journey that combines theoretical knowledge with practical experience. By following this structured approach—starting with the basics, exploring the platform, diving into the documentation, and engaging with the community—you’ll be well on your way to mastering Convex.

As with any new technology, continuous learning is key. Stay updated with new features, keep experimenting, and leverage the resources available to you. With persistence and dedication, you’ll unlock the full potential of Convex and use it to build powerful, data-driven applications.

Articles

The CROWDFUND Act: everything you need to know

One portion of the new law, the CROWDFUND Act, has been creating a lot of buzz in Silicon Valley for months, as it will make it legal for startups the ability to raise money in small chunks from large numbers of non-accredited investors.

The CROWDFUND Act has plenty of supporters who believe crowdfunding could revolutionize startup investing. Skeptics argue that crowdfunding will have unintended consequences, from fraud to a bubble of epic proportions.

So who is right? Unfortunately, few of the articles and blog posts about the CROWDFUND Act appear to be written by individuals who have taken the time to read its text. As such, much of the discussion around the future of crowdfunding and the impact it will have is ill-informed.

So what does the CROWDFUND Act really say, and what does that mean for the startup ecosystem? Here’s what you need to know.

Funding Portals

Not surprisingly, a whole host of companies have popped up in recent months and weeks seeking to cash in on the crowdfunding craze. Many of them are positioning themselves to be Kickstarter-like intermediaries, connecting companies and investors, taking a cut of the action in the process.

The CROWDFUND Act requires that these so-called ‘funding portals’ register with the SEC through one of multiple means, and burdens them with certain obligations. Those include implementing procedures to reduce fraud, such as performing background checks on company directors and executives, and making sure that investors don’t invest more than they’re permitted to under the law.

Beyond the obligations the newly-enacted legislation explicitly spells out, the CROWDFUND Act tasks the SEC with establishing more detailed rules for funding portals — rules that these portals will be required to comply with.

What you need to know

There are certainly going to be interesting opportunities for crowdfunding portals, but far too many are jumping the gun in an effort to get into this nascent space. It’s not clear that many of the wannabe intermediaries launching websites will actually have the financial and legal resources to register as funding portals under the CROWDFUND Act.

As many of the rules and regulations around funding portals won’t be known for months, entrepreneurs interested in raising money through crowdfunding and investors interested in buying shares in crowdfunded startups should probably take a wait and see approach before getting involved with any company claiming it’s going to be a funding portal.

Disclosure Requirements

All companies seeking to raise money will need to disclose certain information, such as the legal status of the company, the names of directors and officers, a description of how the funds raised will be used, how the price of the company’s stock was determined, the company’s capital structure, and legal terms associated with the securities being sold.

Additional information will be required based on the amount of money a company is looking to raise:

- A company seeking $100,000 or less will have to provide an income tax return for the most recently completed year (if any) as well as financial statements which are “certified by the principal executive officer…to be true and complete in all material respects.”

- A company seeking $100,001 to $500,000 must provide financial statements that have been reviewed by an independent public accountant in accordance with “professional standards and procedures” or specific procedures that the SEC establishes specifically for this purpose.

- A company seeking more than $500,000 are required to provide audited financial statements.

Every year, all companies will be required to provide to their investors “reports of the results of operations and financial statements of the issuer, as the [SEC] shall, by rule, determine appropriate” and if that’s not enough, companies will need to “comply with such other requirements as the [SEC] may, by rule, prescribe, for the protection of investors and in the public interest.” That, of course, leaves the door wide open for the SEC to clamp down if fraud becomes a problem.

Needless to say, companies will incur costs in complying with all of the above. An attorney will reasonably be required to put together the initial paperwork. CPA firms can charge thousands of dollars to review financial statements and audited financial statements often cost upwards of $10,000 to produce. For companies raising $100,000 or less, the financial disclosure requirements are less onerous, but it’s worth considering that a chief executive with good judgment will be hesitant to certify that her financial statements are “true and complete in all material respects” without the involvement of a CPA.

What you need to know

There’s no such thing as a free lunch and the CROWDFUND Act isn’t going to change that. Raising money through crowdfunding and keeping up with compliance will require both time and money.

Based on the requirements spelled out in the CROWDFUND Act, companies hoping to raise money should probably be prepared to spend tens of thousands of dollars on attorneys and accountants, making them the two parties which may stand to gain the most from this law.

Liability

Crowdfunding will give entrepreneurs and owners of existing businesses a new means of raising capital, but it doesn’t come without risk. Under the JOBS Act, investors can bring suit against a company they’ve invested in for material misstatements and omissions. Liability extends to the company’s directors and principal officers, so individuals at the helm of crowdfunded companies will be taking on a significant amount of responsibility when they accept investment.

What you need to know

It didn’t take the lawyers long to pounce on Groupon when it made an accounting blunder and crowdfunded startups shouldn’t expect attorneys to give them a free pass either. Keeping the Is dotted and the Ts crossed is going to be a must for crowdfunded companies, and inexperienced business owners and those who skimp on competent legal and accounting counsel could easily find themselves facing financial ruin at the hands of their own investors.

Investor Restrictions

The investment limits placed on individuals have been widely discussed, but individuals considering participating in crowdfunding should also be aware of the less talked about restrictions that will apply to the securities they purchase.

The most important: securities purchased through a crowdfunded offering cannot be sold or transferred for one year unless they are sold back to the issuing company, an accredited investor, a family member or as part of a registered offering. In other words, crowdfunded investments are likely to be illiquid for at least one year from the date on which they’re purchased.

What you need to know

Dumping a stock that you’ve fallen out of love with or that’s plummeting in value is generally easy when the stock is publicly traded, but investors will find little room for buyer’s remorse once they put money into a crowdfunded company. In a worst case scenario, investors may have no way to exit an investment before it loses most or all of its value.

Key Takeaways

So where does all of this leave crowdfunding? There are four important takeaways interested parties should take away from the CROWDFUND Act.

Regulations are dead, long live regulations.

Regulations that once prevented companies from raising capital from non-accredited investors through public channels are going away, but that doesn’t mean that the regulations the CROWDFUND Act creates are trivial. Funding portals and companies alike will still have plenty of rules to comply with. In the end, those rules may not be sufficient enough to prevent the fraud some are worried about, but they will require those wishing to participate in the crowdfunding ecosystem to jump through more than a few hoops.

It will take money to raise money with crowdfunding.

Starving entrepreneurs looking for an easy way to fund their dreams will probably be disappointed by crowdfunding. With the disclosure rules mandated by the CROWDFUND Act, it’s hard to see an entrepreneur or business owner getting an offering off the ground with less than a five-figure investment.

What’s more: there’s no guarantee that the investment will pay off, as the CROWDFUND Act requires that an offering reach a certain threshold of investor commitments before would-be investors are obligated to put their money up. That means some companies could actually lose money when they prepare offerings that aren’t successful.

There may be fewer investment opportunities than expected.

There can be little doubt that some companies will turn to crowdfunding to raise capital, but the time and money required to comply with the CROWDFUND Act may mean that far fewer opt to go the crowdfunding route than crowdfunding’s supports expect.

Technology startups may have a tough time.

Much of the discussion around the crowdfunding portion of the JOBS Act centers on the law’s impact on technology startups. But it’s not clear that the attention is well-placed.

Technology startups with traction or an experienced management team typically don’t have a problem raising funding today, particularly in Silicon Valley. On the flip side of the coin, it’s questionable as to whether idea-stage startups without revenue, traction and an experienced management team will be able to muster up the money, paperwork and interest required to get a crowdfunded offering off the ground.

With this in mind, there’s a strong argument to be made that the companies most likely to stand out in the crowdfunding crowd will be established small businesses with some traction and a plausible need for expansion capital.

Articles

Intra Company Loans: Understanding the Basics and Best Practices

In today’s interconnected business world, intra-company loans have become a crucial financial tool for multinational corporations and small enterprises alike. This article delves into the nature of intra-company loans, their benefits, risks, tax implications, and best practices for implementation.

What Are Intra-Company Loans?

Intra-company loans refer to the lending of funds between different entities within the same corporate group. These loans can occur between parent companies, subsidiaries, or even branches operating under the same umbrella. The primary purpose is to facilitate cash flow management, fund operational needs, or support strategic investments.

Types of Intra-Company Loans

- Short-Term Loans: These are typically used for immediate cash flow needs, with repayment periods often under a year. They can help manage working capital effectively.

- Long-Term Loans: Aimed at financing long-term projects or investments, these loans can extend over several years, allowing for larger capital expenditures.

- Interest-Free Loans: Sometimes, companies may choose to extend interest-free loans to subsidiaries. While this can support cash flow, it raises tax considerations.

- Subordinated Loans: These loans are lower in priority in terms of repayment, often used for higher-risk investments.

Benefits of Intra-Company Loans

Intra-company loans offer several advantages for businesses:

- Flexibility in Financing: Companies can tailor loan amounts, terms, and interest rates to meet specific operational needs.

- Cost-Effective: Borrowing within the corporate group can be less expensive than obtaining funds from external sources, particularly for firms with strong internal cash reserves.

- Tax Efficiency: Properly structured intra-company loans can help optimize a company’s tax position. Interest payments may be deductible, reducing the overall tax burden.

- Cash Flow Management: Intra-company loans can help manage cash flow efficiently, enabling companies to allocate resources where they are most needed.

Risks Associated with Intra-Company Loans

While there are many advantages, businesses must be aware of the risks involved:

- Regulatory Scrutiny: Tax authorities may scrutinize intra-company loans to ensure they adhere to transfer pricing regulations. Non-compliance can result in hefty fines.

- Debt Management: Companies must carefully manage their debt levels. Excessive intra-company lending can lead to financial instability within the group.

- Currency Risks: For multinational corporations, intra-company loans in different currencies can expose the business to exchange rate fluctuations.

- Operational Complexity: Managing multiple loans across different jurisdictions can complicate financial reporting and compliance.

Tax Implications of Intra-Company Loans

The tax implications of intra-company loans are significant and must be navigated carefully:

Transfer Pricing Regulations

Most countries require that intra-company loans be set at arm’s length, meaning the terms should reflect what independent entities would negotiate. This is to prevent profit shifting and ensure that each entity pays its fair share of taxes. Companies must maintain comprehensive documentation to support the terms of the loans.

Interest Deductibility

Interest payments on intra-company loans may be tax-deductible, but this depends on local regulations and whether the loans meet the arm’s length principle. Corporations must also be mindful of thin capitalization rules, which may limit the amount of interest that can be deducted.

Best Practices for Implementing Intra-Company Loans

To maximize the benefits and minimize risks, companies should consider the following best practices:

- Document Everything: Maintain thorough documentation of all intra-company loan agreements, including terms, interest rates, and repayment schedules. This will help in case of audits.

- Set Clear Terms: Clearly define the loan terms, including amounts, interest rates, and repayment timelines, to avoid misunderstandings and ensure compliance with transfer pricing regulations.

- Monitor Financial Health: Regularly assess the financial health of subsidiaries receiving loans. Ensure that they can meet repayment obligations without compromising operational stability.

- Seek Professional Advice: Given the complexities involved, it’s advisable to consult with tax advisors or legal experts to ensure compliance with local and international regulations.

- Regular Reviews: Periodically review the terms and structure of intra-company loans to adapt to changing business conditions and regulatory environments.

Intra-company loans can be a powerful financial tool for businesses, providing flexibility, cost savings, and effective cash flow management. However, they come with their own set of challenges, including regulatory scrutiny and tax implications. By understanding the intricacies of intra-company loans and following best practices, companies can leverage this financial instrument effectively while minimizing risks.

In an ever-evolving global marketplace, intra-company loans represent not just a means of financing but also a strategic element in corporate financial management. As such, businesses must approach them with careful planning and a thorough understanding of both benefits and obligations.

Articles

Mobile Banking Firm Monitise Announces 40 New Jobs in Nantgarw

In a significant boost to the local economy, Monitise, a leading mobile banking firm, has announced the creation of 40 new jobs in Nantgarw. This development underscores the company’s commitment to expanding its operations and enhancing its service offerings in the rapidly growing mobile banking sector.

Overview of Monitise

Monitise has been at the forefront of mobile banking innovation, providing secure and user-friendly solutions for financial transactions through mobile devices. The company’s technology enables banks and financial institutions to offer their customers a seamless banking experience, from payments to account management. With a global presence, Monitise continues to evolve in response to the ever-changing landscape of digital finance.

Job Opportunities in Nantgarw

The announcement of 40 new jobs is a testament to Monitise’s growth trajectory and its dedication to investing in local talent. These positions will encompass a variety of roles, including software development, customer support, and project management. By creating these jobs, Monitise aims to attract skilled professionals who are passionate about technology and innovation.

Benefits of Working with Monitise

Employees at Monitise will benefit from a dynamic work environment that encourages creativity and collaboration. The company is known for its commitment to employee development, offering various training programs and opportunities for career advancement. Additionally, Monitise promotes a healthy work-life balance, making it an attractive employer in the region.

Economic Impact on Nantgarw

The introduction of new jobs by Monitise will have a positive ripple effect on the Nantgarw community. It will not only reduce unemployment rates but also stimulate local businesses as new employees spend their earnings in the area. Furthermore, the presence of a reputable tech company like Monitise can attract other businesses and talent to Nantgarw, contributing to long-term economic growth.

Supporting Local Communities

Monitise is also committed to giving back to the community. The company plans to engage in various local initiatives, supporting educational programs and tech training to inspire the next generation of professionals in the fintech industry. This commitment to community engagement aligns with Monitise’s values and enhances its reputation as a responsible corporate citizen.

Monitise’s announcement of 40 new jobs in Nantgarw marks an exciting chapter for both the company and the local community. As the demand for mobile banking solutions continues to rise, Monitise is well-positioned to lead the charge, fostering innovation and providing valuable employment opportunities. This development not only strengthens the company’s foothold in the region but also promises to uplift the local economy, making Nantgarw a hub for technological advancement in financial services.

For those interested in joining a forward-thinking company in the fintech space, Monitise’s new job openings represent a unique opportunity to be part of a transformative industry.

-

SEO6 months ago

How to Increase Conversion Rate in 2024: 15 Effective Strategies

-

GamersX6 months ago

Call of Duty: Black Ops 6 Officially Announced, Full Reveal on June 9

-

SEO6 months ago

What is SEO and how it works

-

WordPress5 months ago

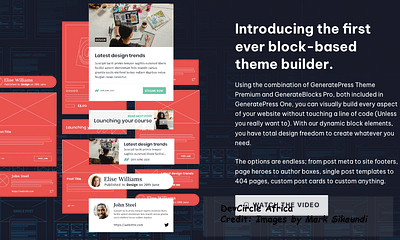

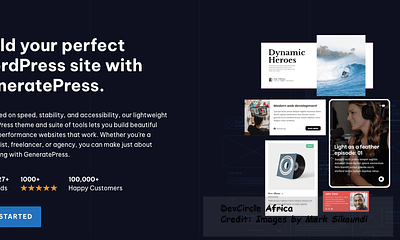

GeneratePress 3

-

SEO6 months ago

Is Google Keyword Planner worth it?

-

SEO5 months ago

Tips for Successful SEO Optimization for Personal Trainers

-

SEO6 months ago

Which is better, Google Keyword Planner or SEMrush?

-

WordPress5 months ago

Generatepress 3 Templates